Press Release No 17 –

Reserve Bank of Fiji to Implement New Monetary Policy Framework

Press Release No. : 17/2010

Date : 14 May 2010

The Reserve Bank of Fiji (RBF) has today announced that it will implement a new market- based monetary policy framework with effect from 17 May 2010.

Under the new framework, the RBF will set an Overnight Policy Rate (OPR) to signal the stance of monetary policy. An increase in the OPR will signal a tightening of monetary policy while a reduction indicates an easing. The OPR, in turn, will serve as the target rate at which commercial banks will lend to each other in the interbank market. The OPR will be initially set at 3 percent with effect from 17 May and will be reviewed regularly by the RBF.

An important feature of the new framework is the disclosure of reasons for any widening of commercial banks’ interest rate spread from the current levels of 4 percent. In addition, the banks will be required to publish their Base Lending Rates (BLR), which will serve as a reference rate for the public.

According to the Governor of the Reserve Bank, Mr. Sada Reddy, “Under the new monetary policy framework, changes in the OPR are expected to be passed to other interest rates in the market, including commercial bank deposit and lending rates. Movements in deposit and lending rates are anticipated to influence consumption and investment activity and, therefore, economic conditions in the country. Changes in consumption and investment activity will, in turn, impact on prices and the balance of payments. We believe that this modern framework will improve linkages between the RBF’s OPR and other interest rates in the market and assist us in achieving our twin objectives of monetary policy – namely low inflation and adequate foreign reserves.”

Please refer to the attached for further details on the framework.

ATTACHMENT

NEW MONETARY POLICY FRAMEWORK

The new monetary policy framework is aimed at improving the effectiveness of monetary policy implementation by the Bank. It constitutes the following changes :-

- Introduction of an Overnight Policy Rate (OPR) – The OPR will be the new policy indicator rate, used to indicate the stance of monetary policy taken by the RBF. The RBF will influence liquidity conditions to move the overnight inter-bank rate towards the OPR. A change in the OPR will signal a change in the monetary policy stance of the Bank, and is expected to transmit to changes in other interest rates in the market. An increase in the OPR will mean a tightening of monetary policy and a reduction will mean that monetary policy is being eased. The OPR will be initially set at 3 percent with effect from 17 May 2010 and will be reviewed regularly and changed depending on the policy stance of the Bank.

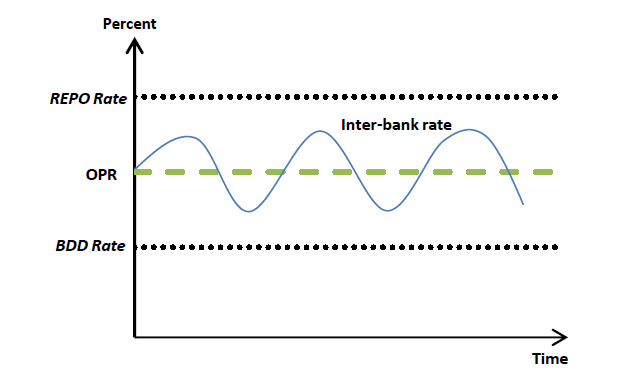

- Introduction of an Interest Rate Corridor – To minimise interest rate volatility, the RBF has introduced a corridor, at 50 basis points (bps) on either side of the OPR. The interest rate at which banks may borrow from the RBF under the Repurchase Facility (REPO) will form the upper limit of the band. The interest rate paid on banks’ demand deposits (BDD) held at the RBF will be 50 bps below the OPR. This will form the lower limit of the band. During the day, banks will trade amongst themselves for liquidity needs, at rates within the corridor, before utilising the REPO at the RBF.

- Removal of Selected Lending Facilities – To simplify the monetary policy framework and further enhance the effectiveness of monetary policy under the new approach, the RBF announces the removal of its current Unsecured Advance and Re-discount Facilities.

- Removal of remuneration on Statutory Reserve Deposits (SRD) – The RBF also announces the removal of remuneration on SRD of banks.

- In addition to the above changes and to complement the monetary policy framework the Reserve Bank also announces measures to enhance the transparency of pricing of financial products and services by commercial banks :-

- Disclosure of Interest Rate Spread increases. The controls on bank spreads were removed from January 2010. However, any increases from 4 percent will now be mandated to be disclosed to the public in a press statement based on an agreed format with the RBF.

- Disclosure of Base Lending Rates (BLR). All commercial banks will be required to publish a base lending rate, which will serve as a reference rate for the public.