International Remittances and Fiji’s Unsung Heroes Abroad 24 December 2020

Following the adverse impact of COVID-19 on the global economy and the actual trend of remittance flows, the World Bank in its October Migration and Development Brief estimated that remittances to low and middle-income countries (LMICs) would fall by 7.2 percent in 2020. The main factors contributing to this decline included weak economic growth and job losses in migrant-hosting countries, weak oil prices; and depreciation of the currencies of remittance-source countries against the United States (US) dollar.

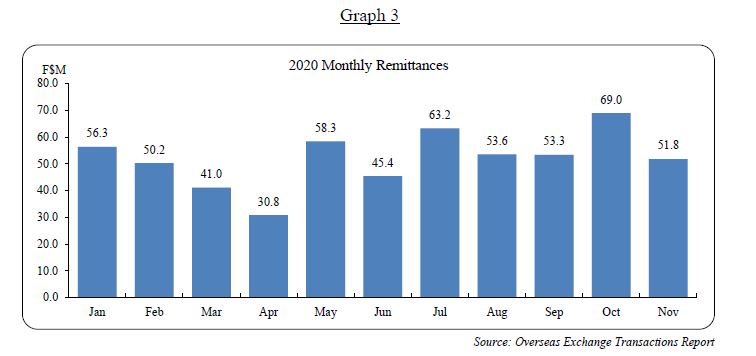

However, Fiji’s total remittances received from January to November this year has exceeded expectations, surpassing last year’s highest monthly remittance inflow of $60.5 million, twice. With restricted borders and tourism travel, remittances are on track to displace tourism as the major foreign exchange earner this year, much to the credit of Fijians working and living abroad.

Defining International Remittances

International remittances refer to the transfer of money to domestic households from family and friends working or living abroad. Formally, it represents household income from foreign countries arising mainly from the temporary or permanent movement of people to those nations. It includes cash sent through formal channels, such as electronic wire transfers via banks or foreign exchange dealers. Remittances are also transmitted through informal channels, such as money carried by individuals across borders or via the hawala or hundi system that is common in countries with underdeveloped financial systems.

Contribution to the Economy

Remittances can help build a home, send a child to school, pay for medical bills and sustain livelihoods, making them a central part of many economies too. Higher remittance flows benefit a country in terms of higher foreign exchange earnings that in turn improve livelihoods and credit worthiness of recipient households thereby facilitating access to financial services, and enabling investments in human and other capital. Remittances also support economic activity in countries with less developed financial systems. According to the World Bank, in 2019, remittance flows to LMICs were larger than foreign direct investment and official aid to the region, making it an essential source of capital for developing countries.

Remittances have been increasing steadily over the years, making it a substantial source of foreign exchange earner for many countries, especially developing nations like India, China, Mexico, Philippines and Egypt. In 2019, global remittances were around US$715 billion, of which US$554 billion flowed to LMICs.

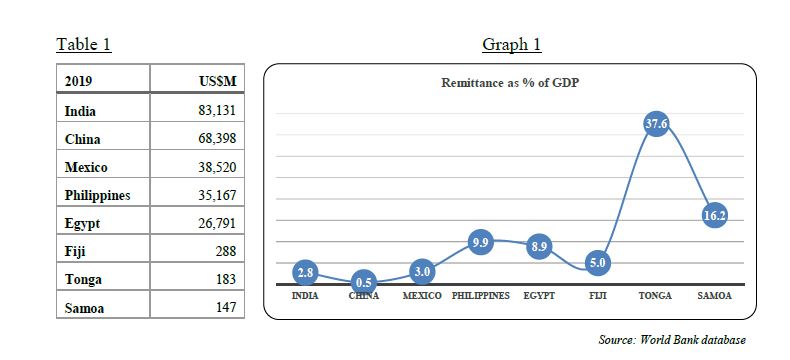

Pacific Island Countries (PICs) remain some of the most remittance-dependent economies in the world. While the remittance value for PICs may be smaller than other bigger countries (Table 1), they represent a larger share of these countries’ total output or Gross Domestic Product (GDP). In 2019, remittance inflows to Tonga and Samoa were amongst the highest in the world, as a share of these nations’ GDP (Graph 1).

Remittance Trend in Fiji

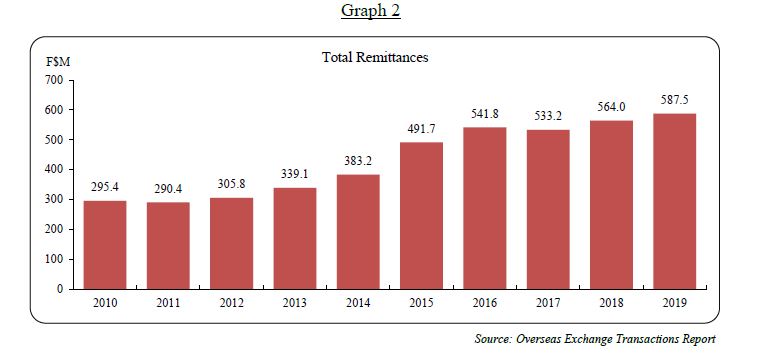

In Fiji, remittances over the last ten years averaged F$433.2 million, equivalent to 4.7 percent of GDP, with more than 60 percent of the funds originating from Australia, New Zealand and the United States. In 2019, remittances sent through formal channels (F$587.5m) accounted for 5.0 percent of GDP, just slightly lower than inward foreign direct investment (F$694.1m). However, given that a sizeable amount of remittances also comes through mobile money platforms and informal channels, the actual inflows could be much higher.

Remittances have become a key source of income at the household level when regularly received from family members, relatives and friends overseas. Gifts, the largest component of remittances, are considered a one-off transaction from family and friends on occasions such as marriage, birthdays, funerals etc. These gifts are often sizeable in the Pacific due to people’s close attachment to their culture and traditions. According to the Fiji Bureau of Statistics Household, Income and Expenditure Survey Reports, remittances represented around 4.0 percent of total household income in 2002-2003. From 2008-2009, remittances had more-than-doubled to around 9.0 percent, and further rose to 10.5 percent by 2013-2014 where it ranked second after wages and salaries.

Remittances Post COVID-19

From February to April, following the intensification of the COVID-19 pandemic, the flow of remittances into Fiji fell markedly (Graph 3). However, inflows started to pick up as the pandemic persisted and job losses rose, prompting Fijians living abroad to increase their assistance to their families back home. Since May, monthly remittances have gradually increased, reaching record highs in July and again in October when F$69 million was received. Cumulative to November, total remittances were F$572.9 million, an increase of 6.4 percent over the same period last year.

Inward remittances through the mobile money platform increased by 278.6 percent to $50.4 million from January to October, compared to the same period last year. Easing of lockdown restrictions in key remittance source countries such as the United Kingdom and the US along with the removal of service fees by mobile operators underpin the spike in transfers via this platform. Looking at recent trends, the Reserve Bank of Fiji estimates that total remittances for 2020 will grow by around 6.0 percent to slightly more than F$600.0 million.

This year, with restrictions on international travel and its negative impact on tourism, remittances will overtake tourism as the largest foreign exchange earner. The outcome is certainly supportive of Fiji’s external position as it partly offsets the losses from tourism and helps stimulate consumption and broader economic activity.

Leveraging the current momentum

In light of the trend in international remittances over the years, one cannot ignore but acknowledge the immense contribution of Fijians living and working abroad to households and individuals in Fiji. Research has shown that families and friends residing abroad are inclined to provide financial support even when encountering financial hardship. As such, funds remitted contribute to improvements in livelihoods and welfare at the household level and economic growth at the national level. It is also important to ensure that such inflows are channelled not only to consumption, but also to productive activities, investments and where possible, savings.

Recognising the immense benefits that remittances bring to the country, the Reserve Bank continues to work closely with development partners and financial institutions to promote financial literacy and financial inclusion programs in Fiji. Such programs provide basic financial knowledge that would help recipients to use the funds not only for consumption purposes but also for investment.

Additionally, the Reserve Bank continues to collaborate with mobile money service providers, money exchange dealers and commercial banks to facilitate cheaper, easier and faster transfer of international remittances to Fiji.

RESERVE BANK OF FIJI