In this article, we will highlight the need to understand the concepts of risk and return while investing and how they are interrelated. Some individuals make the mistake of only looking at the return from an investment without also considering the risk.

What is Return?

The return on an investment is the reward you receive for investing your funds. These rewards typically come in two forms:

1. Income – An investment may pay a sum of money to the investor from time to time. For example, if you invested in a term deposit or bond, you get regular interest payments. If you invested in shares, the company may pay you dividends when it makes a profit. The amount and regularity of the income you receive will vary from one investment to another.

2. Capital gain – Apart from income, an investment may increase in value, allowing you to sell it at a profit (i.e. at a higher price than you bought it for). This is called capital gains. On the other hand, the investment could also lose value instead, which means you would make a loss if you sold it.

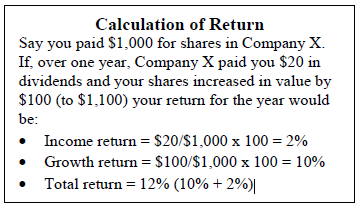

Typically, returns are expressed as a percentage of the initial cost of the investment. These can be referred to as “income return” and “growth return”. The aggregate of the two is called the “total return” (refer to box on “Calculation of Return”).

What is Risk?

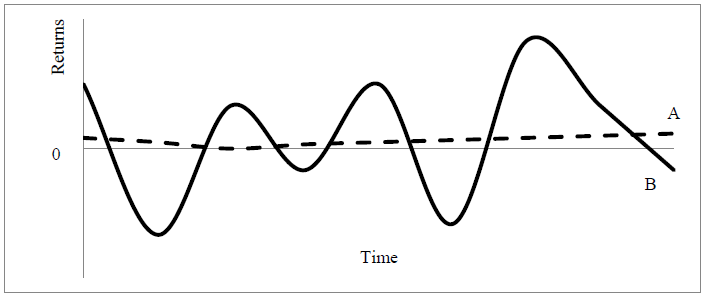

Risk indicates the variability of returns associated with investing over time. Thus, the more an investment’s returns go up and down over time, the more risky it is said to be. This is because, as an investor, the more your investment returns fluctuate over time; the less certain you will be about what you can expect to get in future. Greater uncertainty means that there is a greater likelihood that you could get poor returns from your investment or potential to earn significant returns.

This is illustrated in the graph on “Risk vs Return” – Investment B’s returns fluctuate much more over time than investment A’s. Hence, B is said to be riskier than A. It also indicates that high risk can pay high returns.

While there are many factors that affect the riskiness of an investment, these can be broadly grouped into three categories:

1. Market Risk – This is a risk that is associated with unexpected economic, political or other conditions that could affect the returns that can be made on the various investments in the market. For example, political instability, the level of economic growth, Government policy, inflation and the level of interest rates can all affect the returns on the various investments in the market. Market risk affects all investments to varying degrees.

2. Industry Risk – Industry risk relates to a particular segment, or industry, within the overall market. For example, if the prices of garments fell in international markets, the performance of local garment manufacturers which export garments would tend to be negatively affected. A likely result of this is a fall in the share prices of companies operating in the garment industry.

3. Specific Risk – Specific risk relates to the performance of a particular investment. For instance, the return on a particular share will depend on the company issuing the share. A profitable company will have a better chance of paying dividends on its shares and generating capital growth than a loss-making company. Likewise, the shareholders in that company are exposed to the quality of the company’s management, processes, workers and other resources which are all sources of specific risk.

The Relationship between Risk and Return

As a general rule, investments with high risk tend to have high returns and vice versa. Another way to look at it is that for a given level of return, it is human nature to prefer less risk to more risk. Therefore, the higher the risk of an investment, the higher its returns have to be to attract investors. The existence of risk does not mean that you should not invest – only that you should be aware that any investment has some degree of risk which should be considered when deciding whether the expected returns of that investment are worth it.

Therefore, when considering the suitability of any investment, you must understand both the likely returns and the risks involved. The appropriate risk-return combination will depend on your financial objectives. Some people prefer a low-risk, steady income stream while others don’t mind taking on more risk for the chance of making higher returns.

Managing Risk through Diversification

One way in which risks can be reduced is to invest in a range of investments or, as the saying goes, “don’t put all your eggs in one basket”. This is commonly referred to as “diversification”. Why does diversification work? This is because different investments tend to experience good performance at different times. By not having all your funds in one investment, poor performance by any one investment will tend to be compensated by better performance by other investments. In this way, the combined return from your investments is levelled out over time i.e. your overall risk is reduced. However, as a general rule, risk cannot be completely eliminated, even through diversification. This is because some risks will tend to affect all investments, no matter how you combine them.