Press Release No 9 –

Reserve Bank Introduces Flood Rehabilitation Facility

Press Release No. : 09/2009

Date : 01 April 2009

The Reserve Bank of Fiji today announced the introduction of the Flood Rehabilitation Facility (FRF).

The Governor, Mr. Savenaca Narube said “The Flood Rehabilitation Facility is a new facility offered by the Reserve Bank to provide assistance to businesses affected by the recent floods to obtain credit at a concessionary interest rate”. He added that the facility will complement the initiatives already offered by commercial banks.

The total amount available under this facility is $20 million. The FRF will be offered through the commercial banks and Fiji Development Bank (FDB). The Facility is available only to businesses affected by the recent floods. Businesses may apply for funds for the following:

- Replacement of flood-damaged inventory;

- Loss of sales (including working capital) due to the flood;

- Repair or replacement of flood-damaged plant, equipment and machinery;

- Restoration of flood-damaged buildings including resorts and hotels; and

- Replacement of business vehicles damaged by the flood.

The maximum interest rate charged to eligible customers under this facility is 6.00 percent per annum. The term of the loan under this facility is a minimum of 6 months with the possibility of extension. Shorter term loans will be assessed on a case-by-case basis.

Application for funding under the Facility is subject to normal credit screening process by the respective commercial bank or FDB.

This Facility is effective immediately and more information, including the eligibility criteria, can be obtained from the FDB, commercial banks or RBF.

GUIDELINES FLOOD REHABILITATION FACILITY

1. Introduction

The Reserve Bank of Fiji (RBF) has established a Flood Rehabilitation Facility (FRF) to assist businesses affected by the recent floods to obtain credit at concessional rates of interest. Through the Facility, businesses may seek funding for either production loss which may include the replacement of flood-damaged stock or inventory, or asset loss which may include the repair of flood-related damages to business premises.

The Facility is available to affected businesses through the commercial banks and the Fiji Development Bank (FDB). Advances to eligible businesses are at the risk of the lender with no recourse to RBF. The total amount available on this Facility is $20 million with loans limited to $0.5 million per business. The $20 million will be allocated on a first-in basis. Granting of loans is at the discretion of the commercial banks and FDB.

This Facility is effective immediately and is available until 30 September 2009.

2. Eligibility

The Facility is available only to businesses affected by the recent floods. Businesses may apply for funds for the following:

- Replacement of flood-damaged inventory;

- Loss of sales (including working capital) due to the flood;

- Repair or replacement of flood-damaged plant, equipment and machinery;

- Restoration of flood-damaged buildings including resorts and hotels; and

- Replacement of business vehicles damaged by the flood.

Clarifications on the above eligibility requirement can be sought from the Reserve Bank.

3. Loan Application

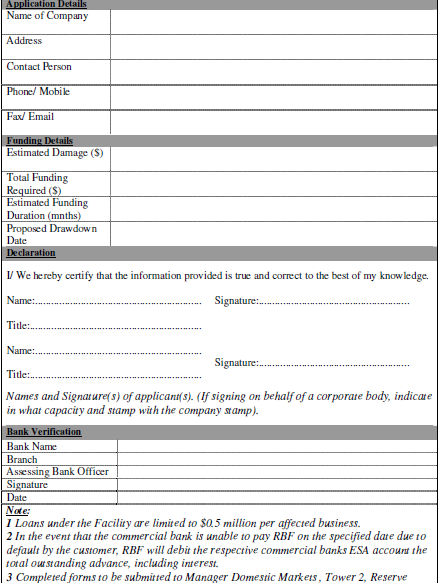

Applications from businesses for funding under the FRF must be submitted through their commercial bank or FDB 3 clear working days before the proposed drawdown date. Applications must be made on the specially designed Flood Rehabilitation Facility application form by the lender on behalf of the client.

4. Loan Term

The term of the loan under this Facility is 6 months, with the provision to roll-over every six months for a maximum of three years1. The interest rate will remain at 2 percent for the duration of the loan. Loans of shorter maturities will be granted on a case by case basis. Where extension is sought to roll-over, commercial banks and FDB must inform RBF at least 2 weeks before maturity of the current loan.

5. Interest Rates

The interest rate charged on the FRF to commercial banks and FDB is fixed at 2 percent. Commercial banks and FDB can then on-lend to businesses at a maximum rate of 6 percent.

6. Loan Disbursement

Upon approval, the RBF will credit the commercial banks exchange settlement account and the FDB call account with full the amount of the advance.

7. Repayment

Under this Facility, commercial banks and FDB are to repay principal plus interest on maturity. In instances where the Facility is rolled-over, only interest due must be paid every six months.

8. Commercial Banks with Existing Flood Rehabilitation Loans

All existing flood related loans by commercial banks can be transferred under the RFR once approved by RBF. However, upon transfer the maximum interest charged should not exceed 6 percent per annum.

9. Lenders Responsibility

Processing of applications under the FRF is delegated to the commercial banks and FDB.

The lenders are responsible for:

- verifying flood damage,

- credit-screening, and

- calculating loan eligibility amounts.

In case of default, the commercial banks exchange settlement accounts and FDB call account will be debited with the total outstanding amount loaned and the interest thereon.

FLOOD REHABILITATION FACILITY APPLICATION FORM