Presentation to The Fiji Employers Federation Impact of The Global Crisis on Fiji’s Economy

Outline

The outline of my presentation is as follows:

- Global Economic Conditions

- Impact of the Financial Crisis on Fiji’s Economy

- Summary

Global Economic Conditions

- According to the latest International Monetary Fund’s World Economic Outlook, the ‘credit crunch’ or ‘liquidity crisis’ that first erupted with the US sub-prime mortgage1 collapse in mid-2007 has entered a new troubled phase in the recent months, unfolding as the “2008 financial crisis”. Regarded as the most severe shock since the Great Depression of the 1930s, the impact has been felt across the global financial system, and is expected to result in a major downturn in the world economy.

- Intensifying solvency concerns have badly shaken confidence, pushing the global financial system to the brink of meltdown, leading to emergency resolutions in the major advanced economies. Stock markets across the globe have fallen significantly and money and credit markets have frozen, causing severe stress in financial systems and resulting in the failure of several large financial institutions in the United States and Europe. The financial crisis together with high energy and commodity prices is pushing many countries, including the most advanced economies, to the brink of economic recession. Concerted efforts by central banks and governments to mitigate the crisis, has seen financial rescue and economic stimulus packages amounting to billions of dollars being implemented.

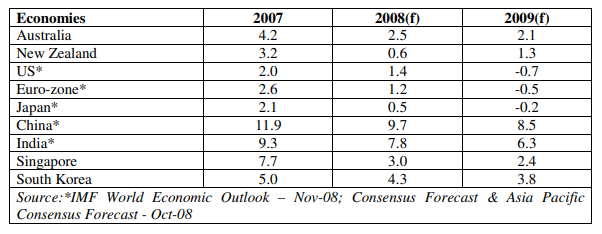

- Consequently, in its November 2008 forecast, the IMF revised its global growth projection down to 3.7 percent from 3.9 percent for this year. The IMF further revised the 2009 world growth projection down to 2.2 percent from the earlier projection of 3.0 percent. We therefore expect our major trading partners to have a sluggish outlook for the next two years. Emerging economies, like China and India, are also expected to experience some slowdown in growth but will continue to experience relatively high growth rates and may provide some stability to global growth.

Impact of the Financial Crisis on Fiji’s Economy

- Fiji’s Financial Sector: Overall, Fiji’s financial sector is quite insulated from the financial markets abroad and the banking, insurance and other financial institutions remains sound. The crisis is affecting the financial institutions in foreign countries on two fronts – (1) Financial Institution’s ability to lend due to the liquidity shortage; and (2) Confidence in the financial sector. In case of Fiji, both of these prominent features are absent since – (1) our banking system is flush with liquidity; and (2) our banking institutions are sound and prudent in their management of funds, thus it provides the confidence for the depositors.

Regular updates and assurances by the Reserve Bank of Fiji to this effect play a key role in maintaining confidence in Fiji’s financial system. Moreover, unlike the foreign banking system, the domestic financial system is financed from local depositors and credit is extended to domestic entities – in this respect, Fiji is immune from the global financial crisis.

The insurance industry is relatively sheltered from the effects of the financial crisis.

- Macroeconomic Impact: Fiji, being a small open economy in the world, is heavily dependent on its major trading partners for trade and financial flows. Currently, the US, UK Japan and Euro-zone are directly exposed to the financial crisis, which will have significant implication for other major economies around the world. In addition, the possibility of a recession in the US, UK, Japan and Euro-zone, will definitely have repercussions for our other major trading partner countries (Australia and New Zealand) given the strong trade and financial links with these mature economies. The effects of the financial crisis could indirectly trickle down to the Fijian economy transmitted via the possibility of economic downturn in trading partner economies which could lower demand for exports and reduced financial flows from the major trading partner economies. Overall, the potential risks to Fiji’s macro-economy from the financial crisis are on the downside.

- Impact on Exports: Exports may be affected selectively. Demand for fish, mineral water and garments, textiles & footwear may ease somewhat as a result of the slowdown in US, Japan and Australia, which are Fiji’s major markets for these products. Overall, a marginal adverse impact on exports is expected from the global slowdown.

- Impact on Imports: A relatively weaker domestic economy may also weaken the import growth. This may be most evident in the import of intermediate goods, mainly oil, and other investment goods. Lower prices of commodities in the international markets will also help weaken import growth for other food items, such as wheat, rice and dairy products.

Crude Oil Prices: In the first 10 months of the year, oil prices have averaged US$108 per barrel. Since its peak of US$146 in July, oil prices have since declined, currently around $US58 per barrel. Strong demand from emerging economies like China, combined with supply disruptions, geo-political concerns, the weak US dollar and speculative demand amidst the US financial crisis have underpinned the movements in oil prices. Prices are anticipated to remain high in the months ahead.

- Impact on Tourism and Remittances: While there are mixed views on visitor arrivals, there is a mild possibility of a slower growth next year in line with the economic slowdown envisaged in our major tourist markets. This in turn will lower tourism earnings without any compensatory increases in per diem expenditure. If the Asian destinations are affected, they may respond aggressively with discounts – if Fiji were to compete accordingly with them, yields for the domestic industry could be affected further.

Remittances may also be affected, given that the labour market conditions in the advanced economies will be affected. Nevertheless, it is important to note the remittance already started declining in before the financial crisis started in 2007. Therefore, this financial crisis could exacerbate the decline in remittances flows.

- Impact on Foreign Direct Investment: Most of the foreign investments are financed, in large part, through loans from external banks and other institutions. The tight global liquidity conditions could restrain foreign borrowing to finance investment in Fiji by non-residents, as well as residents. As a result, FDI into Fiji may be affected negatively. On the other hand, non-residents could also withdraw their existing investment and re-invested earnings to meet their offshore financial or liquidity needs, especially by offloading, say real estate investments in Fiji.

- Impact on Exchange Rate and Competitiveness: The US dollar is generally perceived to be the safest of currencies and is in high demand in times of crisis. This has been the case with the current financial crisis where exceptional demand for the US dollar has strengthened the currency while weakening other currencies. In this regard, the Fiji dollar is expected to weaken against the US dollar. The appreciation of the USD will augur well for exports to the US or goods priced in USD. However, this will be offset by the losses from the Australian and New Zealand dollars, both of which have weakened against the Fiji dollar. While it is not clear where the trading partner currencies are headed, there is a general agreement that the US dollar will continue to strengthen against the major currencies.

In addition, our external competitiveness could be affected by competition from Asian economies, as they normally keep an undervalued exchange rate to boost their exports and services (e.g. tourism) sectors.

Exchange Rates: Compared to the beginning of the year, the Fiji dollar strengthened against the Australian and NZ dollars by around 12 and 13 percent, respectively. However, the Fiji dollar fell against the US dollar and Euro by 13 and 2 percent, respectively.

- Impact on Economic Growth: The risk to the Fiji economy from the financial crisis is on the downside. This can be largely attributed to the expected negative effects emanating from the trade and financial channel. That is, if exports of mineral water, fish, garments, textiles & footwear and other domestic exports (like agro-based produce) potentially decline then this will naturally feed into lower production in these sectors. In addition, any slowdown in tourism would impact the wholesale & retail trade, hotels and restaurants sectors, as well as, the air transport and services allied to transport sectors adversely. Furthermore, a reduction in remittances flows could suppress consumption expenditure. Similarly, lower financial flows (especially, FDI) could lead to a decline in investment, especially in the building & construction sector. Thus, domestic demand may be affected as a result of the global financial crisis. It is likely that the financial crisis will erode Fiji’s growth prospects somewhat.

- Impact on Fiji’s Monetary Policy Objectives: In terms of the monetary policy objectives, the global slowdown will ease inflationary pressures. Although there is some appreciation in the US dollar, oil prices have dropped more sharply. On a net basis, this is expected to ease inflationary pressures from oil.

In contrast, it is likely that pressures on foreign reserves (the underlying position of the Balance of Payments (BoP)) may increase as a result of anticipated weaker tourism earnings & remittances, lower FDI and export earnings from selected commodities.

Consequently, the Reserve Bank of Fiji will maintain tight money and credit policies.

Summary

- The impact of the financial crisis on Fiji will be via the impact on its major trading partner economies

- Financial sector assessment reinforces the soundness of the banking, insurance and other financial institutions

- Macroeconomic threats are firmly on the downside