Making an investment is more than just putting money in a savings account or purchasing some property. Today, investors have a range of products to choose from. These include purchasing shares or units, investing in fixed income securities such as bonds, and other products. This article will focus on investing in bonds.

What are bonds?

A bond is a type of investment where the investor (the bondholder) lends money to a borrower e.g. government, statutory authorities or a company (the issuer). In exchange, the issuer gives the investor a bond certificate, which acts as proof that the issuer owes money to the bondholder. Bonds can be sold to other investors.

In some ways, a bond is similar to a bank loan. The issuer pays the bondholder interest (called the coupon) at an agreed interest rate throughout the life of the bond. Bond investment terms (time period) vary but are always for periods greater than one year. At the end of the bond term, the issuer pays the amount borrowed back to the bondholder along with the final interest payment. In Fiji, bonds are mainly issued by the Fiji Government and a number of statutory bodies such as the Fiji Development Bank and the Housing Authority of Fiji. Bonds may also be issued by private sector organisations such as that by Future Forests (Fiji) Limited.

General Bond Example

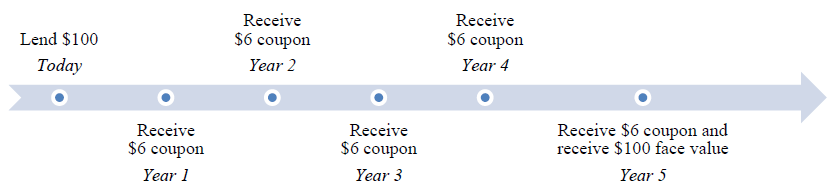

We will use an example to help illustrate the flows of money when investing in a bond and to familiarise the reader with bond terminology.

In this example, the price of a 5 year bond that pays an interest rate of 6 percent per annum is $100. By investing in the bond, the bondholder is lending $100 to the issuer for a period of 5 years (also known as the life of the bond). The face value is $100 and is the amount the investor receives at the end of the bond life. The interest rate or coupon rate is 6 percent and is paid out to the bondholder each year. This means that for every year throughout the life of the bond, the bondholder receives coupon payments totalling $6 by year end.

Bond interest payouts may be made monthly, every three months, six months or yearly depending on the frequency of coupon payments. The Fiji Government “Viti Bond” is one example of a bond that pays out interest every three months. However, coupon on all other bonds issued in Fiji is paid semi-annually.

Why invest in bonds?

Bonds can be a good investment for several reasons. Let’s take a look at some of the benefits:

- Regular income – the coupons provide a steady and regular income stream. It could be a means for receiving a consistent cash inflow with minimal risk to your invested capital.

- Relatively low risk – bonds are basically a debt which the issuer has a legal obligation to repay. This means that bondholders generally rank ahead of shareholders in priority. For example, if the issuer becomes insolvent and goes into receivership, bondholders and other people owed debts would be repaid first before ordinary shareholders.

- Diversify your investment – adding bonds to your other investments can reduce your total investment risk. This is called diversification and can be described as “not putting all your eggs in one basket”. By spreading your money over several investments, you reduce the impact if one of your investments begins to lose money.

- Ease of buying and selling – buying and selling bonds can be conveniently done if the bonds are actively traded on the stock exchange by licensed brokers and dealers. You can also choose to sell only part of your total bond holding.

- Choice – since there is a range of bond issuers with different coupon rates and maturity dates, investors can select those bonds that suit their income needs.

What are the risks of investing in bonds?

Like any other investments, bonds are not free of risk. Good investors consider and understand the risks of prospective investments before they make investment decisions. Let’s take a look at some of the risks that apply to bonds.

- Interest rate risk – interest rate and bond prices are inversely related. If interest rates in Fiji rise, the value of bonds held as investment will fall. The bondholder will have to decide whether to keep the bond or to sell it in the stock market. If the decision is made to keep the bond, the bondholder faces the risk of the value of the bond falling further. If the decision is made to sell the bond, the bondholder faces the risk of a valuation loss.

- Credit risk – this is the risk that the issuer may be unable to pay bondholders. It depends on the quality of the issuer. A large, profitable and well-managed company is less likely to run into financial problems and default on its payments than a company with a history of losses or poor management.

- Liquidity risk – this is the risk that a bond cannot be easily sold at, or close to, its market value.

- Re-investment risk – a bondholder can invest coupons to obtain more income. However, during times of falling interest rates the value of bonds rise so become more expensive than originally bought. Re-investing coupons at lower interest rates is a risk that bondholders face.

Are bonds suitable for you?

Bonds can be a good investment but they won’t suit everyone. As bonds pay regular coupons, they can be a good option for investors who want to receive regular income. Since interest rate changes in the short term can cause bond prices to fluctuate, bonds are generally more suited to longer-term investors. By holding bonds until they mature, the returns are more certain because the coupons and face value are known. Ultimately, any investment must match your risk-return preference and particular circumstances.