In this article, we examine the actual process of investing and look at some of the investment objectives.

The Importance of Investment Objectives

One of the keys to a successful investment is defining your investment objectives or setting the guidelines that you will follow when you invest. Clearly defined investment objectives provide a target to work towards and one that you can check your progress against. This “investment roadmap” can be an important motivating factor moving forward.

Why am I investing? How long should I invest for? How much should I invest? What level of risk am I prepared to take? These are some of the important questions that you need to answer when defining your investment objectives. Let’s take a closer look at some of these questions.

The Purpose of Investing

As a starting point, determine the reason(s) why you are investing. For example, you may want to buy a house, pay for your children’s education or provide for your retirement. The purpose of investing will determine the other elements of your investment objectives – timeframe, amount, risk and return. Having a clear purpose is probably a better motivational factor than simply investing without a specific goal in mind. It provides you with a “picture” of where you want to go, which you can then work towards.

Risk-Return Preferences

Remember that risk and return go hand in hand. High return investments tend to have high risks and vice-versa. You need to decide whether you can take some risk for the opportunity of earning higher returns, i.e. can you afford to make a loss and how much?

Conservative investors obviously would prefer low risk. Consequently, their investments would tend to have relatively low returns. On the other hand, investors looking for high growth must be prepared to take on higher risk.

The timeframe is also a relevant consideration. For example, short-term investors would tend to go for lower-risk investments. This is because with higher risk investments, there is a relatively greater likelihood that their short-term returns may be less than they were hoping for, hence they could miss their goal altogether. On the other hand, long-term investors would be more willing to invest in higher risk investments as short-term fluctuations are less of a consideration.

You may be looking for safety of principal, ready access to your money and to earn an immediate return. If you do, a possible course of action you might take is to put your money in savings deposits, on which you will earn interest and the value of your principal will not rise or fall. However, the return that you earn will not be as large as returns from other forms of investments.

Alternatively you may be looking for higher returns. Are you willing to assume increased risk to earn higher returns? Do you want to earn income, capital gains or both?

The answers to the questions mentioned above will assist you in determining your investment objectives and whether investing would fit into your objectives. You must not make a decision to invest your money based on emotion. Carefully think about what you want to do and why, identify the risks involved and determine whether you can bear those risks to earn higher income and capital gains. Study all the relevant information and get advice if you can. Remember that the final decision to invest must be yours.

Timeframe for Investing

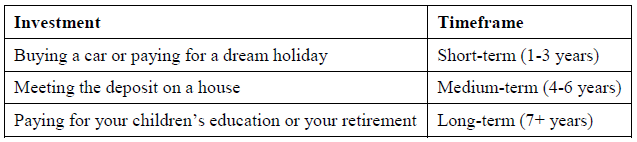

The timeframe will, of course, be driven by your purpose for investing. Some targets can be achievable in a year or two; others may require careful investment over many years. For simplicity, investment timeframes may be grouped into three: short-term (around 1-3 years), medium-term (around 3-7 years) and long-term (more than 7 years). Some typical investment examples with appropriate timeframes include:

Amount to Invest

The amount you need to invest depends on the cash flow required at the end of the investment period (we will refer to this as the “final amount”). For example, you may calculate that you need $5,000 for a holiday in 2 years’ time or 20 percent of the market value of the property in 5 years for a deposit on a house. You can then calculate how much to invest over time to accumulate this final amount.

Most people find it easier to invest small equal amounts on a regular basis, for example, with each fortnightly salary packet. This approach of making regular instalments is recommended and can quickly become a habit.

How much should these regular instalments be? The required calculations involve working backwards from the final amount and taking into account:

- The regularity of payments (e.g. weekly or fortnightly)

- The rate of return that the investor expects to reasonably achieve

- Any lump sum that is available to invest immediately

- Other issues such as the impact of taxes

The calculations also need to recognise the effect of compounding, i.e. over time, an investment can grow at an accelerated rate where income is reinvested. Typically, the calculations are made based on what is called “annuity” formulae. You can consult your financial/investment adviser if you are not sure how to perform these calculations.

Remember, it pays to be realistic. A plan that is too ambitious and which requires you to make many sacrifices or dramatically rearrange your current lifestyle is likely to fail. Such a plan is difficult to keep one motivated. And, when you are faced with unforeseen expenditures, you may end up falling behind on your payments or even abandon your plan altogether.

Once investment objectives have been clearly identified, the next step is to shop around for the best investment options in the market.