Introduction

The performance of an economy is measured by the growth rate of Real Gross Domestic Product (GDP). Real GDP measures the value of all final goods and services produced in a country at a particular period of time, adjusted for price changes or inflation. Broadly, it provides important information on the size of the economy and whether it is growing or shrinking. When Real GDP growth is positive, it indicates that the economy is performing well which means that businesses are growing, more jobs are being created and people have more money in their pockets to spend. Conversely, when the economy is shrinking, it indicates that fewer new jobs are created, hence less hiring and people have less money to spend.

This article explains how Fiji’s economic growth forecasts is undertaken with emphasis on expected growth for 2017 and major factors underpinning the recent upward revision to the growth rate.

Forecasting GDP growth

Fiji’s GDP growth is forecasted twice in a year, in April and October. The indicators used to forecast growth are aligned to the methodology employed by the Fiji Bureau of Statistics with relevant data obtained from various sources including the public sector especially the Ministry of Economy, other Government ministries and statutory bodies and the private sector. Partial indicators of economic activity such as investment and consumption, retail sales and business sentiment surveys and information gathered from industry meetings are also used to forecast growth.

The growth forecasts are prepared by a sub-Macroeconomic Technical Committee before they are deliberated on by the Macroeconomic Technical Committee and finally approved by the Macroeconomic Committee.1 The broad membership of the committee ensures that the forecasts are widely and thoroughly scrutinized to produce projections that are robust, unbiased and credible.

Therefore, the growth forecast is a result of rigorous and meticulous processes involving many technical personnel spanning several government agencies as well as virtually the entire central bank. No other agency in Fiji undertakes such a comprehensive review of the economy.

1 The Macroeconomic Committee is made up of executives and senior officials from the Ministry of Economy; Fiji Bureau of Statistics; Ministry of Industry, Trade & Tourism; Office of the Prime Minister; Investment Fiji; Ministry of Infrastructure & Transport, Fiji Revenue & Customs Service and the Reserve Bank of Fiji.

Fiji’s Economic Structure

To better appreciate the drivers of growth in any economy, it is first important to understand the structure of the economy. For example, a sector that accounts for 30.0 percent of the economy will contribute far more to the economic growth (or conversely to the contraction) than a sector that just accounts for 5.0 percent of the economy.

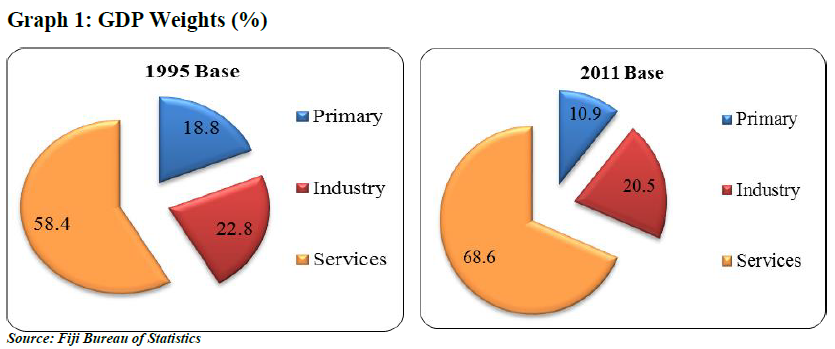

The structure of Fiji’s economy has evolved over the years (Graph 1). In 2016 (2011 base), economic activity was dominated by the service sector with a weight of 68.6 percent followed by the industry (20.5%) and primary (10.9%) sectors. This compares with a lower share of the services sector (58.4%) and the higher shares for the industry (22.8%) and primary (18.8%) sectors two decades ago (1995 base), reflecting the relatively lower share of services-related output to the economy then. The share of the agriculture sector in the economy, in particular has declined from 15.7 percent to 8.2 percent during the same period.

2017 Growth Forecast

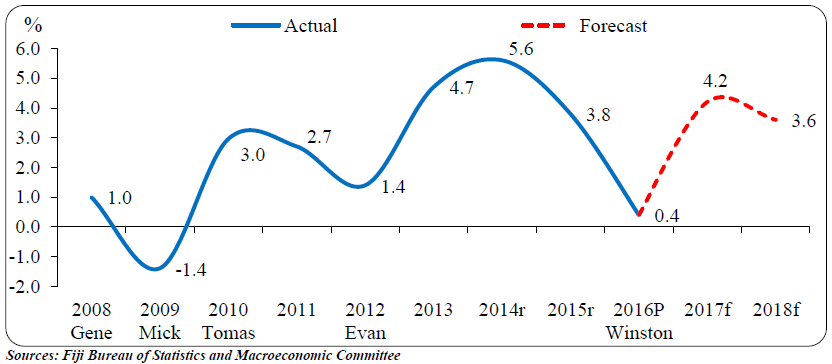

The Fijian economy is forecast to register its eighth consecutive year of growth in 2017 (Graph 2). The upward growth revision to 4.2 percent from 3.8 percent is largely driven by the positive impact from further expansionary fiscal policies2, which have boosted disposable incomes, a low interest rate environment and continued rehabilitation activity post TC Winston. For 2018, the growth outlook has been revised up to 3.6 percent, from the 3.0 percent projected earlier.

2 These include the continuation of the 9.0 percent VAT rate, increase in the minimum tax threshold (from $16,000 to $30,000), higher wages for Government workers and the increment in national minimum wage rate (to $2.68/hour from $2.32/hour).

Graph 2: Actual and Growth Forecast

Drivers of Growth

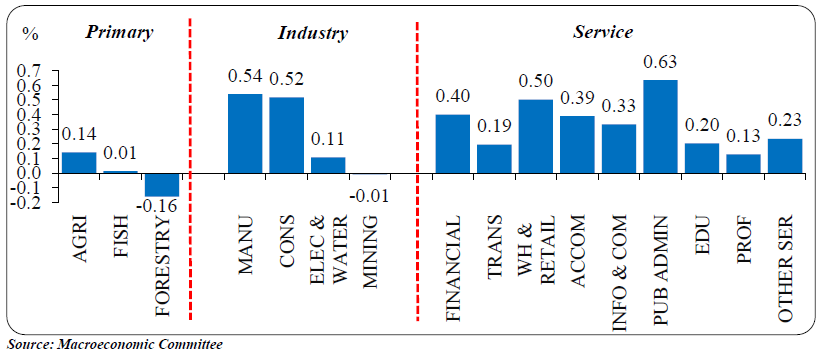

The major sectors underpinning the higher growth forecast for 2017 are envisaged to be the service and industry sectors led by public administration & defence, manufacturing, construction, wholesale & retail, accommodation, finance, education and health (Graph 3).

On the downside, the agriculture sector is forecast to register a lower growth this year as it remains on a recovery path following the devastation from TC Winston and floods, and the prolonged dry weather spell which affected cane output. In addition, the performance of the cane and sugar sector continues to be affected by labour shortages especially during the harvesting season, aging farmers and increasing costs of farming.

Similarly, the forestry sector is envisaged to decline this year underpinned by lower mahogany production associated with the long-standing licensing issue in the industry. Following the withdrawal by Sustainable Mahogany Industries Limited in May 2016 which negatively impacted the sector, the issue of new licenses to 13 new companies on 1 September 2017, is expected to facilitate a return to higher levels of mahogany production from next year onwards.

Graph 3: Sector Contributions to 2017 Growth

Overall, the favourable growth outlook is supported by higher aggregate demand boosted by upbeat consumer and business confidence. Consumption and investment activity are expected to expand further this year supported by higher bank lending to the private sector which is reflective of the continued accommodative monetary policy, ample banking liquidity and low interest rates. Moreover, inflows of inward remittances, increased income levels as indicated by the Pay As You Earn collections and favourable labour market conditions continue to support consumer spending.

Conclusion

Overall, the strong economic growth momentum continues to be broadly supported by stable macroeconomic policies and growing business and consumer optimism.

Like any other forecast, actual growth outturns do deviate from forecasts due to reasons such as lack of timely data, incomplete information and unexpected outcomes. As such, the Macroeconomic Committee will continue to enhance its forecasting processes to ensure that forecast variances are minimised.