Complaints Management Update

March Quarter 2016

A. Background

In January 2010, the Reserve Bank of Fiji (RBF) issued its Supervision Policy on Complaints Management to the Licensed Financial Institutions (LFI’s)1.

The Policy requires LFI’s to implement a Complaints Management Framework that will effectively and efficiently resolve complaints by customers of LFI’s. The Policy also enables customers who are dissatisfied with the outcome of their complaints with the LFI’s to refer their complaints to the RBF for mediation and resolution.

This report provides an update on the complaints referred to the RBF in the first quarter of 2016. The complaints data provided in this report excludes the complaints received and resolved by the LFIs at their level.

B. Highlights

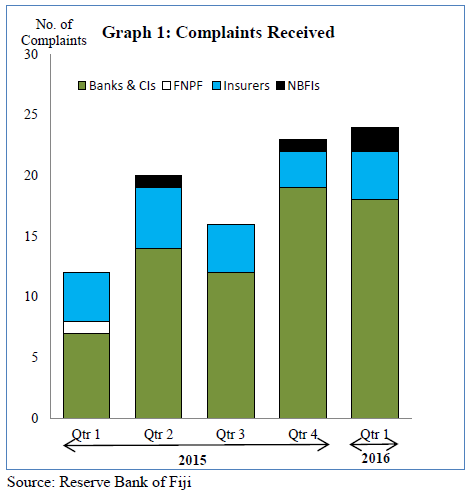

In the first quarter of 2016, 24 complaints were referred to the RBF for mediation and resolution.

This was a marginal increase from 23 complaints received in the fourth quarter of 2015. Similarly, an increase was noted in

1 Commercial Banks, Credit Institutions, Capital Market Participants, Insurance Companies or brokers, FNPF and Foreign Exchange Dealers

the complaints received when compared to the same period last year.

The complaints received were related to the insurance, banking and credit institutions and non-bank financial institutions (Graph 1).

C. Complaints Analysis

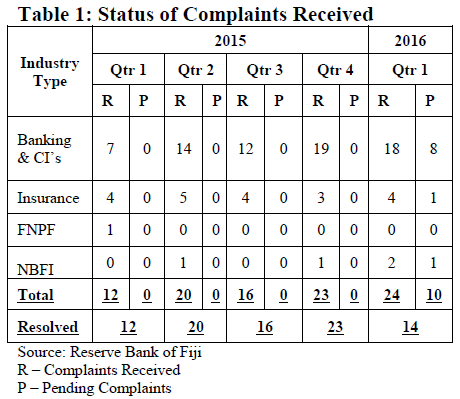

In the review quarter, ten complaints remained unresolved. Nine of these are currently being assessed by the financial institutions and a complaint is with RBF awaiting mediation (Table 1).

D. Complaints under investigation and resolved

For the March 2016 quarter, 58 percent of the complaints were resolved.

Resolution to these complaints included reversal of fees and charges, bringing the complainant and LFIs together to better understand their rights and duties, providing clarity of the transaction details, payment of interest and assisting customer to get service from their preferred service providers rather than the approved panel of service providers as per financial institutions liking.

E. Types of Complaints Received

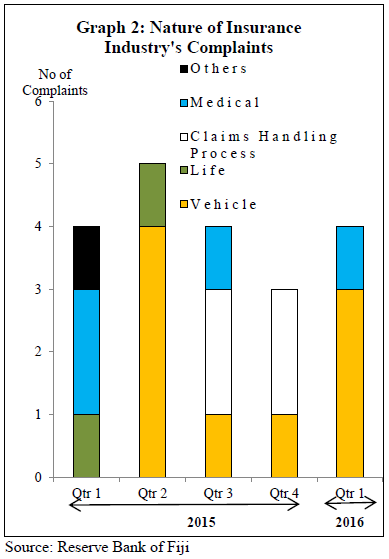

The complaints received by the RBF regarding the insurance industry were on motor vehicle insurance and medical insurance (Graph 2).

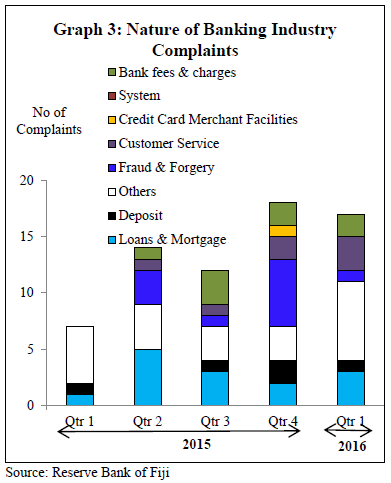

The nature of complaints received by the RBF on the banking and credit institutions were mainly on fees and charges, fraud, deposits, loans and mortgages, errors in processing and customer service (Graph 3).

F. Consultative Meetings

During the quarter, the RBF held 15 meetings with complainants to resolve their complaints.

In addition, the RBF held four meetings with financial institutions. These meetings involved mediation and clarification of issues raised by complainants.

G. Other Major Activities

In the review quarter, RBF conducted an onsite examination of an insurance company to ensure its compliance with the requirements of Insurance Supervision Policy No. 9 Policy Guideline on Complaints Management.

The Complaints Management Forum had its first meeting for the year on February 26 2016. The Forum discussed issues relating to complaints experienced by the licensed financial institutions.

Reserve Bank of Fiji

April 2016