Complaints Management Update

September Quarter 2016

A. Background

In January 2010, the Reserve Bank of Fiji (RBF) issued its Supervision Policy on Complaints Management to the Licensed Financial Institutions (LFIs)1.

The Policy requires LFIs to implement a Complaints Management Framework that will effectively and efficiently resolve complaints by customers of LFIs. The Policy also enables customers who are dissatisfied with the outcome of their complaints with the LFIs, to refer their complaints to the RBF for mediation and resolution.

This report provides an update on the complaints referred to the RBF in the September quarter of 2016. The complaints data provided in this report excludes the complaints received and resolved by the LFIs at their level.

B. Highlights

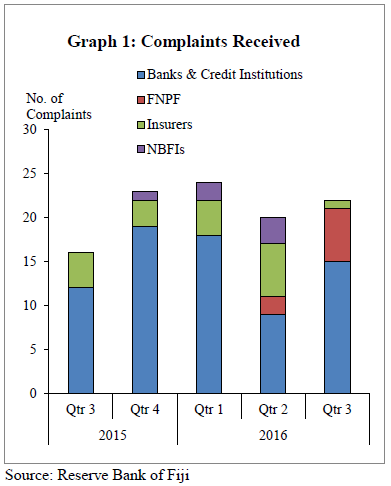

In the September quarter of 2016, 22 complaints were referred to the RBF for mediation and resolution.

This was an increase from 20 complaints received in the previous quarter. Similarly

1 Commercial Banks, Credit Institutions, Capital Market Participants, Insurance Companies or brokers, FNPF and Foreign Exchange Dealers.

year on year there was an increase of 6 complaints.

The complaints received were related to the Banks and Credit Institutions, Insurers and Fiji National Provident Fund (FNPF).

C. Complaints Analysis

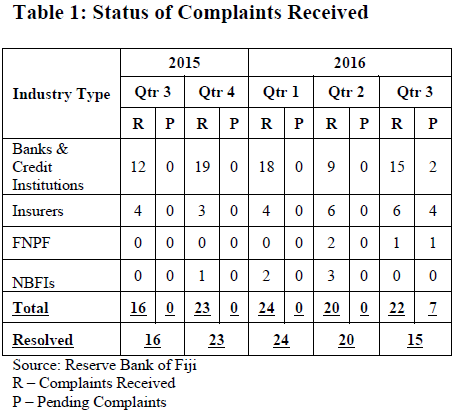

For the review quarter, 15 complaints were resolved and 7 complaints are still pending investigation. Of these 7 complaints, 4 complaints are with RBF for assessment, 2 complaint is with the LFI and the other 1 is with the complainant for verification (Table 1).

D. Complaints under investigation and resolved

For the September quarter, 68 percent of the complaints were resolved.

Resolution of these complaints included helping the customer recover their unclaimed money, assisting the customer to better understand their insurance policy document and the claims procedure, reversal of fees and charges, processing of telegraphic transactions and rebate of interest charged to loan account.

E. Types of Complaints Received

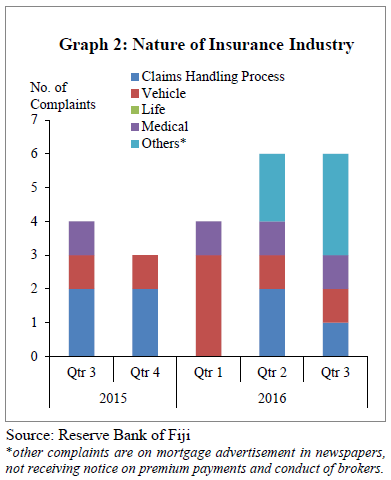

The complaints received by the RBF against the insurers were on motor vehicle insurance, attitude of insurance agents, refund of premium and the claims handling process (Graph 2).

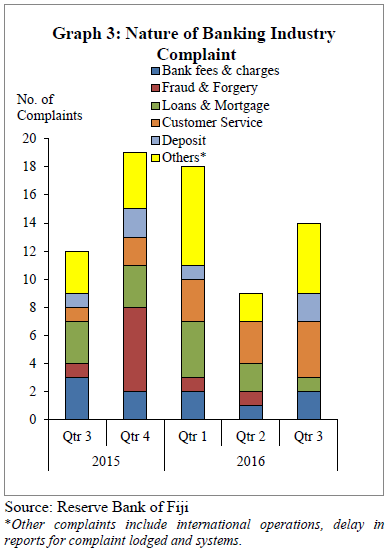

The nature of complaints received by the RBF on the Banks and Credit Institutions were mainly on loans and mortgages, customer service, deposits, fees and charges and international operations (Graph 3).

F. Consultative Meetings

During the quarter, the RBF held 10 meetings with complainants to resolve their complaints.

In addition, the RBF held four meetings with financial institutions. These meetings involved mediation and clarification of issues raised by complainants.

G. Other Major Activities

In the review quarter, the RBF conducted file reviews with two institutions. The reviews were done as part of investigations into complaints.

Follow up visits were done with two LFIs to check on the progress with the onsite findings.

Reserve Bank of Fiji

October 2016