Complaints Management Update Report

A. Background

The purpose of this report is to provide an update on the complaints that the Reserve Bank received at Quarter 4, 2013.

B. Highlights

Overall, the number of complaints recorded in Quarter 4 of 2013 decreased by 39 percent when compared to the previous quarter. However, annually, the number of complaints increased by 120 percent.

Majority of complaints received were for banking fees and charges, lending and mortgage related complaints, terms and conditions of insurance policy and declinature of insurance claims due to non-disclosure of material information.

The Reserve Bank will work closely with Licensed Financial Institutions (LFIs) to effectively manage and resolve complaints.

Currently, the Reserve Bank and the Fiji Commerce Commission is working on a Memorandum of Understanding.

During the quarter, spot checks were conducted on all LFIs in Suva on the display of their complaints posters in their branches. Majority of the LFIs complied with the requirement.

C. Complaints Analysis

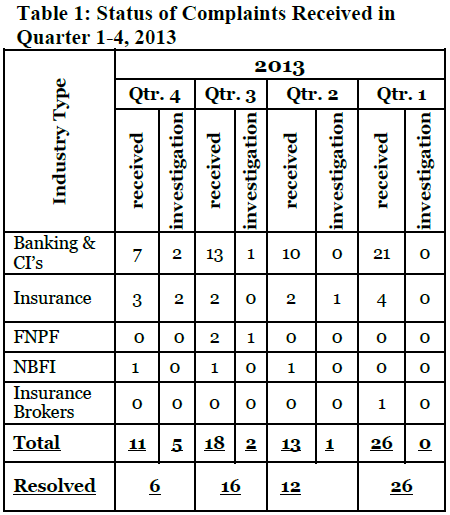

Types and number of complaints received in Quarter 4

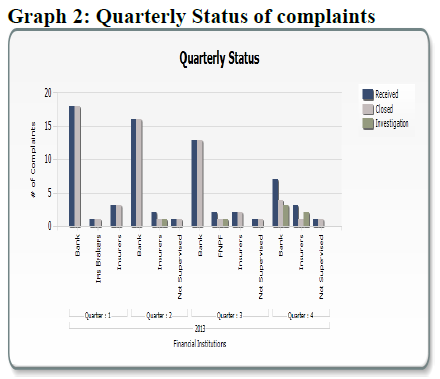

The number of complaints received in Quarter 4 by the Reserve Bank decreased by 39 percent when compared to Quarter 3. Majority of the complaints were banking related (bank fees and charges, lending and mortgages).

OUR VALUES…Professionalism…Respect…Integrity…Dynamism…Excellence

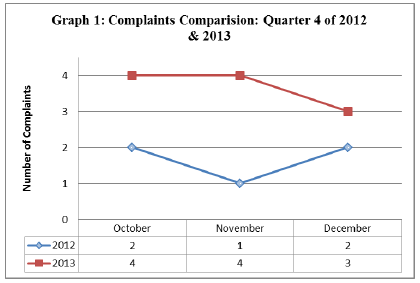

Annually, the number of complaints received by the Reserve Bank in quarter 4 increased by 120 percent. This is mainly noted in the increase in the number of complaints registered in the quarter 4 when compared to the previous year.

Complaints Pending for 2013

For Quarter 4 of 2013, the numbers of complaints that are under investigation or pending to be closed were 5 complaints. All of the pending complaints are with the LFIs.

Similarly, for Quarter 3 of 2013, 2 complaints are with the LFIs. These complaints were on unlawful withdrawals and Members Funds with the FNPF.

For the second quarter of 2013, there was only 1 complaint pending investigation. This was in regards to the Terms and Conditions of a Group insurance policy.

D. Types of Complaints Received

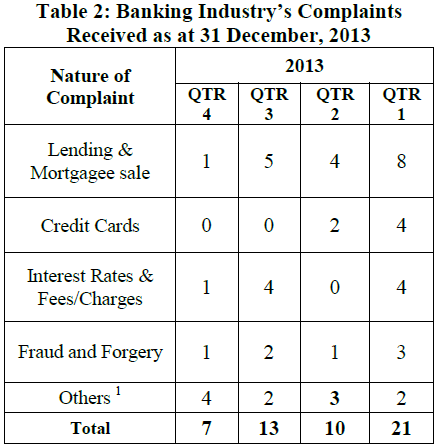

The nature of complaints received by the Reserve Bank on the banking industry was mainly on lending, mortgagee sales, interest rates, fees/charges and Fraud and Forgery (Table 2).

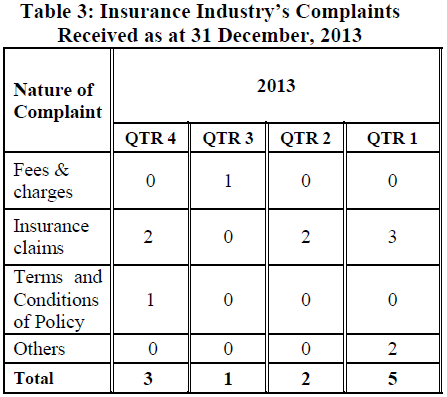

The complaints received by the RBF against the insurance industry were mainly on refutation of insurance claims by the insurers due to non-disclosure of material information. (Table 3)

1 Table 2: Others ( Regulatory/Policy, Unlawful Withdrawal & Deposit)

E. Consultative Meetings

During the quarter the Reserve Bank held 13 meetings with complainants. These meetings were aimed at addressing concerns raised by the complainants.

In the quarter, Reserve Bank held 21 meetings with financial institutions. These meetings were on issues raised by complainants and on ways to resolve them.

F. On site Supervision

In line with the resolution of July 2013 Complaints Management Forum Meeting regarding Complaints Management Posters, 16 spot checks were conducted in Suva (this includes Banks and Credit Institutions, Insurance Companies and FNPF) to ensure compliance with the policy guideline on Complainants Management. Most of the LFI’s displayed the posters at strategies location which are frequented by the public.

G. Complaints Management Forum

The third Complaints Management Forum was held on 29 November 2013.

Financial System Development Group

Reserve Bank of Fiji

17 January 2014